How Data Laws Impact Donor Management

Nonprofits must adapt to evolving data privacy laws to protect donor trust and ensure compliance, navigating risks and operational challenges.

Nonprofit donor management is facing new challenges in 2025 due to evolving U.S. state data privacy laws. With 13 states already enforcing privacy laws and more set to follow, nonprofits must navigate a complex web of legal requirements. Some states exempt tax-exempt organizations, while others impose stricter rules. Noncompliance risks include fines, lawsuits, and reputational damage, as nearly 70% of donors prioritize trust before contributing.

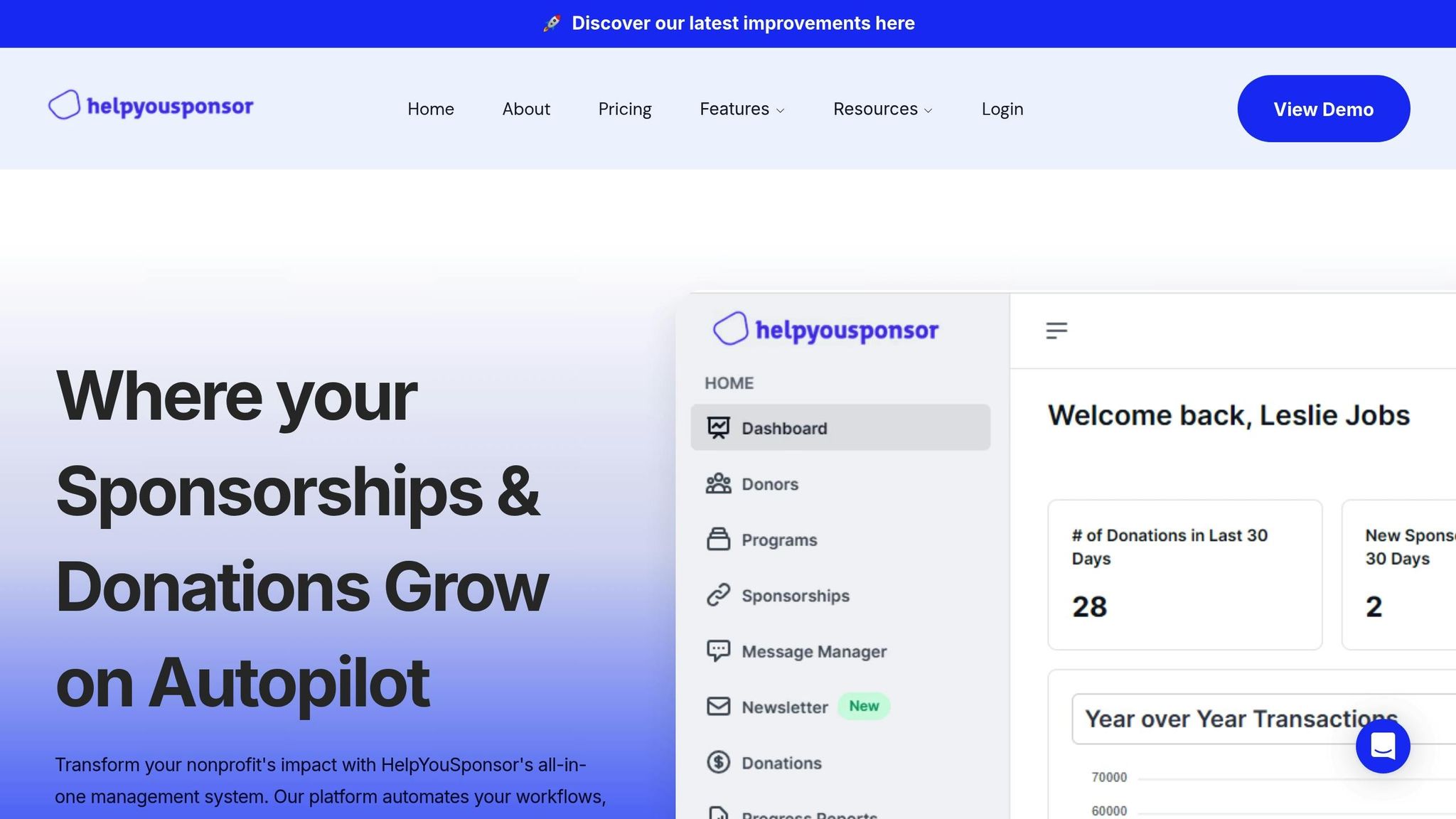

To address these challenges, platforms like HelpYouSponsor simplify compliance by automating privacy notices, securing donor data, and offering flexible, usage-based pricing. In contrast, many other systems require manual updates and additional costs for compliance, making them less efficient and more burdensome for nonprofits.

Key Takeaways:

- States with Privacy Laws: 13 active as of May 2025; Tennessee, Minnesota, and Maryland laws to follow by October 2025.

- Risks of Noncompliance: Fines, lawsuits, and loss of donor trust.

- HelpYouSponsor Features: Automated compliance tools, secure data handling, and scalable pricing starting at free.

- Other Platforms: Often require manual updates, costly consultants, and additional staff training.

HelpYouSponsor is tailored to help nonprofits meet legal requirements while focusing on their mission, offering a simpler, more cost-effective solution compared to other options.

Nonprofit Organization Data Privacy and Security

1. HelpYouSponsor

HelpYouSponsor (HYS) is a donor management platform designed specifically for nonprofits grappling with the complexities of data protection and privacy laws. Developed by industry professionals, it tackles the unique challenges these organizations face in managing donor information while ensuring compliance with ever-evolving regulations. Its features not only streamline compliance but also provide strong security measures and flexible scalability.

Compliance Features

HelpYouSponsor integrates essential compliance tools directly into its donor management system, making it easier for nonprofits to meet legal requirements without interrupting their fundraising efforts. The platform centralizes donor data, ensuring transparency and control in line with state-mandated privacy laws.

An automated communication system takes care of sending receipts, thank-you notes, privacy notices, and policy updates to donors. This automation helps nonprofits stay compliant with disclosure requirements while keeping donors informed and engaged.

Data Security Measures

To protect sensitive donor information, HelpYouSponsor employs role-based access controls, meaning only authorized staff members can view or manage specific data. This limits access based on job roles, reducing the risk of unauthorized exposure.

By consolidating donor data, sponsorship tracking, and donation processing into one secure system, the platform minimizes the risks associated with managing information across multiple tools. This centralized setup ensures better oversight and tighter control over data handling practices.

Flexible Pricing

HelpYouSponsor offers a pricing model that adjusts to the size and needs of your organization. Instead of requiring large upfront investments, the platform charges based on usage, making it accessible for nonprofits of all sizes.

- Free Plan: Covers up to 10 commitments per month.

- Pro Plan: $39/month for up to 80 commitments.

- Max Plan: $0.50 per commitment with no limit on scaling.

This tiered structure allows nonprofits to scale their investment in compliance and data management gradually, ensuring they only pay for what they need as their programs grow.

2. Other Donor Management Platforms

Many donor management platforms require nonprofits to invest extra time and resources to keep up with evolving data protection laws. Unlike HelpYouSponsor, which includes built-in compliance tools, traditional platforms often rely on manual processes, creating challenges for nonprofits trying to stay compliant without overextending their budgets.

Compliance Features

Traditional platforms tend to handle compliance in a reactive way. Nonprofits are often left to manually set up protocols for regulations like GDPR, CCPA, CAN-SPAM, and IRS rules. This includes managing opt-in processes and preference centers, which increases the chances of errors and leaves room for compliance gaps. To address these gaps, staff frequently need extensive training to document data handling procedures and create standard operating procedures (SOPs). On top of that, nonprofits are usually responsible for staying up-to-date with regulatory changes by working with technology consultants to adjust security measures. This approach not only increases complexity but also makes it harder to adapt to new data protection laws.

Response to Changing Laws

When regulations shift, these platforms often require manual updates, which can expose compliance weaknesses. Nonprofits may face steep financial penalties if these gaps aren't addressed quickly. Many platforms provide little support, leaving organizations to navigate regulatory changes on their own. This means nonprofits must develop clear data privacy policies, conduct regular audits, and update donor data proactively to avoid falling behind.

Data Security Measures

Most standard platforms offer basic encryption and access controls, but they still require additional configuration and regular audits to ensure security. When nonprofits use multiple disconnected systems, the risks become even greater. Managing donor data across different platforms can introduce vulnerabilities and make it harder for staff to follow consistent security protocols. Organizations often need to spend extra on security audits to identify and fix these issues, adding to the overall complexity and cost.

Cost Effectiveness

The hidden costs of using traditional platforms can add up quickly. Fees for consultants, staff training, and security audits - as well as potential penalties for noncompliance - can make these platforms less budget-friendly. Advanced security features and compliance tools often come with premium price tags, forcing smaller nonprofits to choose between robust protection and staying within their budget. When evaluating costs, nonprofits must account for the full range of expenses required to maintain compliance and safeguard donor data. These expenses can place a heavy burden on operations, diverting resources away from the organization's core mission.

Platform Advantages and Disadvantages

When selecting a donor management platform, nonprofits must carefully consider the pros and cons of each option. This decision is especially important as evolving data protection laws increasingly affect operational efficiency and long-term planning. Below, we compare integrated platforms like HelpYouSponsor with more traditional systems to help illustrate these differences.

HelpYouSponsor provides a suite of integrated features designed to simplify compliance with regulations like GDPR, CCPA, and the CAN-SPAM Act. This setup allows organizations to focus on their mission without constantly worrying about adapting to new legal requirements. Its usage-based pricing model also offers flexible plans that can scale as the organization grows.

That said, while HelpYouSponsor’s automation tools reduce routine tasks, new users may face a learning curve when adapting to its comprehensive feature set. This could be a challenge for smaller or newer nonprofits as they familiarize themselves with the platform.

On the other hand, traditional donor management platforms tend to offer greater customization and easier integration with existing systems. These platforms are often praised for their detailed reporting capabilities and long-standing use by many organizations. They typically include features like detailed audit trails and robust data export options. However, a major downside is that when regulations change, these systems often require manual updates. This process frequently involves hiring expensive consultants, conducting additional staff training, and overhauling protocols - all of which can pose significant financial risks. For example, GDPR violations alone can result in fines of up to €20 million or 4% of annual revenue, whichever is higher.

| Feature | HelpYouSponsor | Traditional Platforms |

|---|---|---|

| Compliance Tools | Built-in tools for GDPR, CCPA, and CAN-SPAM | Manual setup, often requiring consultant help |

| Response to Law Changes | Automated updates and notifications | Manual updates, with potential compliance gaps |

| Starting Cost | Free (up to 10 commitments/month) | $45–$99/month for entry-level plans |

| Enterprise Pricing | $0.50 per commitment | $4,000+ annually (some exceeding $300/user/month) |

| Security Measures | Integrated encryption and access controls | Basic encryption, often requiring extra setup |

| Staff Training Required | Minimal ongoing training | Quarterly or biannual compliance training |

The cost differences between these platforms are another key factor. While traditional platforms may start at around $4,000 per year, additional expenses for compliance consultants, security audits, and staff training can quickly add up - diverting funds from the nonprofit’s core mission.

Traditional platforms also often require dedicated compliance officers and regular internal audits to address gaps in data handling. Staff may need to navigate complex processes for managing opt-ins, data retention policies, and preference centers. These challenges can make organizations vulnerable during transitions to new regulatory standards, further emphasizing the need for systems that can adapt seamlessly to legal changes.

For smaller nonprofits operating with limited budgets, the total cost of maintaining compliance through traditional platforms can be particularly overwhelming. It’s essential to weigh whether the benefits of greater customization justify the higher costs and operational challenges associated with these systems.

Conclusion

This comparison underscores a clear decision: adopting tools with built-in compliance features versus scrambling to adjust to ever-changing regulations. It’s an important consideration for nonprofits aiming to simplify their operations.

HelpYouSponsor offers an integrated compliance solution that aligns with critical security standards like PCI and GDPR. This allows nonprofits to dedicate more energy to their mission instead of constantly tackling regulatory updates.

With its flexible, usage-based pricing model, HelpYouSponsor ensures cost predictability - a stark contrast to the unexpected expenses often tied to traditional systems.

Features like automated duplicate detection, address validation, and built-in adherence to compliance standards make platforms like this well-prepared for future regulatory shifts. On the other hand, organizations sticking with manual processes risk disruptions and potential compliance violations.

For smaller nonprofits, these platforms reduce the need for hiring dedicated compliance staff or investing in continuous training. Meanwhile, larger organizations with complex data management demands must balance the benefits of customization against the added costs and challenges of staying compliant.

Ultimately, platforms designed with compliance at their core save nonprofits from the expensive, time-consuming adjustments required by traditional systems. This lets them channel their resources toward what matters most - fulfilling their mission.

FAQs

How do changing state data privacy laws affect how nonprofits manage donor information?

State data privacy laws in the United States are changing quickly, and nonprofits are feeling the impact when it comes to managing donor information. These laws often push organizations to adopt stricter measures to protect personally identifiable information (PII), be upfront about how donor data is used, and navigate a patchwork of regulations that vary from state to state.

To keep up, nonprofits should focus on implementing solid data security practices, clearly informing donors about their data rights, and regularly checking compliance with new rules. Being proactive doesn’t just help avoid legal trouble - it also strengthens donor trust, a critical factor for successful fundraising and long-term relationships.

What compliance features does HelpYouSponsor offer to ensure donor data protection?

HelpYouSponsor equips nonprofits with powerful tools to securely handle donor information while staying in step with changing data protection laws. Its features include bank-level encryption to protect sensitive data, custom access controls to limit data access to authorized staff, and automated donation receipts to streamline communication with donors.

The platform is also built to comply with major privacy regulations like GDPR and CCPA, ensuring your nonprofit operates within legal boundaries. These tools not only help organizations meet regulatory standards but also strengthen donor trust in an increasingly complex compliance environment.

What risks do nonprofits face if they don't comply with new data privacy laws, and how can HelpYouSponsor help them stay compliant?

Nonprofits that don’t keep up with changing data privacy laws can face legal trouble, a loss of donor trust, and serious reputation damage. These issues can hurt their ability to attract funding and keep their operations running smoothly.

To avoid these challenges, nonprofits should focus on key practices like using strong data security systems, training their teams on privacy procedures, and keeping detailed records of how donor information is managed.

HelpYouSponsor steps in to assist by providing tools for secure donor data management, resources to train staff, and features that simplify compliance record-keeping. These solutions not only help nonprofits stay aligned with evolving regulations but also ensure donor information stays safe and trust remains intact.