Leveraging Technology to Streamline Nonprofit Financial Management

How cloud-based tools automate budgeting, fund accounting, donor management, and compliance to save nonprofits time, reduce errors, and improve transparency.

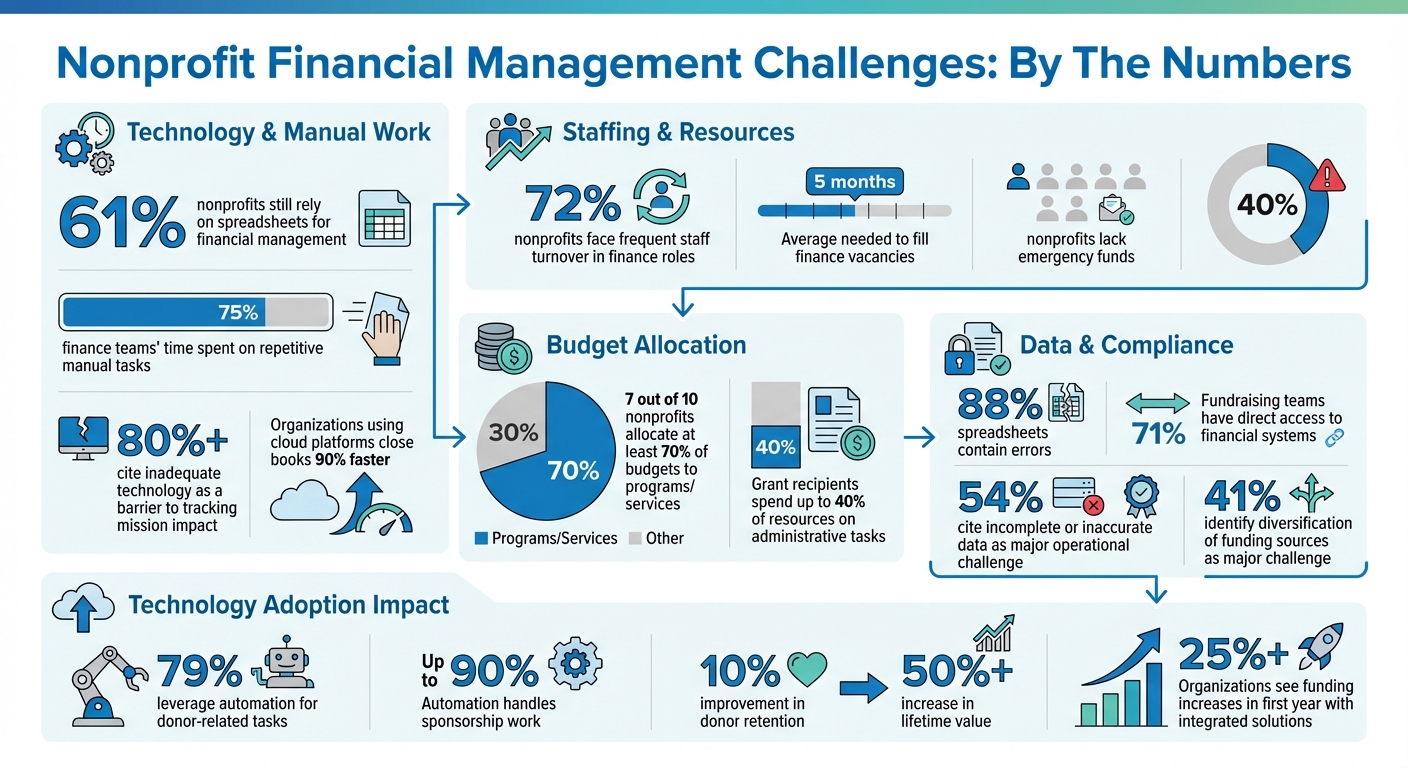

Nonprofits face constant financial challenges: limited budgets, manual processes, and compliance burdens. Over 61% still rely on spreadsheets, while 75% of finance teams' time is spent on repetitive tasks. These inefficiencies hinder strategic decision-making and donor trust.

The solution? Modern financial tools. By automating tasks, improving accuracy, and integrating systems, nonprofits can save time, reduce errors, and focus on their mission. For example, organizations using cloud-based platforms report closing books 90% faster and increasing revenue without expanding staff.

Key takeaways:

- Budgeting: Real-time updates and forecasting tools improve financial planning.

- Expense Tracking: Automated fund accounting ensures compliance with donor restrictions.

- Donor Management: Centralized systems boost retention and streamline donations.

- Compliance: Modern tools simplify reporting and audit processes.

Platforms like HelpYouSponsor combine donation management, fund tracking, and reporting into one system, reducing admin workloads and improving transparency. Investing in these tools not only improves operations but also strengthens donor relationships and organizational impact.

Tools I Recommend for Nonprofit Financial Accounting

Common Financial Management Challenges for Nonprofits

Nonprofit Financial Management Challenges: Key Statistics and Impact

Understanding the hurdles nonprofits face is key to improving financial management. These organizations often operate under tight financial constraints, with only 1 in 7 grant applications succeeding and 40% of nonprofits lacking emergency funds. This financial pressure affects every aspect of their operations.

One striking statistic: 61% of nonprofits still rely on basic spreadsheets for managing finances. As a result, finance teams spend 75% of their time on manual accounting tasks, leaving little room for strategic planning. Adding to the challenge, 72% of nonprofits face frequent staff turnover in finance roles, with an average of five months needed to fill a vacancy. This often forces staff to juggle multiple responsibilities, increasing the risk of errors and burnout.

Budget Constraints and Resource Allocation

Nonprofits frequently operate with razor-thin margins, aiming to maximize their impact while facing limited resources. Seven out of 10 nonprofits allocate at least 70% of their budgets to programs and services, leaving little for operational essentials like accounting systems, office space, or competitive salaries. This situation perpetuates the "Starvation Cycle", where funders hesitate to cover administrative costs, forcing nonprofits to work at less-than-optimal capacity and undermining their missions.

Restricted funding further complicates things. Donors often earmark contributions for specific programs, leaving organizations scrambling to cover indirect expenses like rent or salaries. For instance, a nonprofit might receive $50,000 for a youth mentoring program but lack the flexibility to address operational needs like equipment repairs. This makes precise fund accounting critical to ensure compliance with donor restrictions and avoid legal issues.

Some funders are beginning to address these challenges. In 2023, the United Way of Rhode Island extended its grants to three years (up from two) and removed spending restrictions, allowing nonprofits to focus on long-term planning and operational needs. Similarly, MacKenzie Scott’s 2020 unrestricted grants significantly reduced administrative burdens by requiring only a simple annual report over three years.

Managing Donor Contributions and Commitments

Juggling multiple funding streams adds complexity to donor management. Forty-one percent of nonprofit finance professionals identify the diversification of funding sources as a major challenge. Nonprofits often handle a mix of federal grants, state contracts, foundation awards, corporate sponsorships, individual donations, and event revenue - each with unique reporting requirements and restrictions.

The situation worsens when internal systems don’t communicate effectively. Only 71% of development and fundraising teams have direct access to financial systems. This disconnect can lead to issues like misallocated funds. For example, if fundraising staff commit a $10,000 donation to a project, but finance lacks real-time visibility, the funds might not be allocated properly. Such gaps often result in manual reconciliations, duplicate entries, and errors.

"When donors commit to supporting a nonprofit, they need to know their dollars will be put to good use responsibly and impactfully."

- Tim DeMagistris, National Director of Nonprofits at Workday

Adding to the complexity, over 80% of nonprofits cite inadequate technology as a barrier to tracking their mission’s impact. These challenges highlight the urgent need for integrated financial systems that streamline data and improve transparency.

Meeting Compliance and Reporting Requirements

Compliance is another major obstacle for nonprofits. Federally, organizations must file Form 990 with the IRS, a document publicly available for three years, exposing any financial mismanagement to donors, board members, and the public. Nonprofits receiving more than $750,000 in federal grants face even stricter scrutiny, requiring Single Audits and adherence to Uniform Guidance standards. This threshold will increase to $1 million for fiscal years ending on or after September 30, 2025.

State laws add more layers of complexity, with annual registrations for charitable solicitations varying by state. Nonprofits must also monitor Unrelated Business Income Tax (UBIT) for activities not directly tied to their mission, such as advertising revenue or rental income. Additionally, public charities must meet the "Public Support Test" by demonstrating broad public backing, failing which they risk being reclassified as private foundations with stricter rules.

Limited resources and outdated tools make compliance even harder. Eighty-eight percent of nonprofit finance professionals prioritize accounting standards compliance when choosing software. Yet many organizations lack modern systems to produce the detailed reports grantors demand. Joan Benson from Sage explains:

"Reporting is essential to good stewardship and accountability. It is how organizations measure and demonstrate financial performance."

Without updated tools, finance teams often rely on manual data compilation, making it difficult to provide the real-time transparency that stakeholders now expect. Modern technology can simplify compliance and improve financial transparency.

How Technology Improves Nonprofit Financial Management

Technology is reshaping how nonprofits handle their finances by automating tedious tasks, consolidating scattered data, and offering real-time insights into financial health. Tools designed specifically for budgeting and financial management are becoming more popular, allowing teams to focus on strategy rather than administrative work. Modern platforms eliminate data silos, drastically reducing reconciliation time. By creating a unified source of accurate data, these systems ensure consistency across teams - a crucial improvement, especially since 54% of organizations cite incomplete or inaccurate data as a major operational challenge.

With these advancements, nonprofits are seeing tangible benefits in budgeting, expense tracking, and donor management.

Better Budgeting and Forecasting

Digital platforms have transformed budgeting from a rigid annual exercise into a dynamic, ongoing process. Rolling forecasts, updated monthly or quarterly, allow nonprofits to maintain a continuous 12-month outlook, making it easier to adjust to changing circumstances. This adaptability is critical given that over 60% of nonprofits reported rising operational costs in 2025, while nearly 40% faced funding declines.

Cloud-based systems with built-in controls also improve data accuracy, a significant advantage considering that 88% of spreadsheets contain errors. Scenario planning tools help organizations prepare for uncertainty by modeling best-case, worst-case, and expected outcomes. Driver-based forecasting further refines accuracy by linking financial projections to operational metrics like volunteer hours or program outputs.

Tracking Expenses and Fund Accounting

Specialized software simplifies fund accounting by automatically distinguishing between restricted and unrestricted funds, ensuring compliance with donor and grant requirements. Organizations can tag expenses to specific programs or grants, providing instant clarity on how funds are being used. Mobile apps with OCR (optical character recognition) technology capture receipt details on the spot, reducing the risk of losing documentation. Digital systems also streamline operations by enforcing spending limits and automating approval workflows, minimizing unauthorized expenses.

Cloud-based platforms maintain comprehensive audit trails, linking every transaction to its corresponding ledger entry and supporting documents. Nonprofits using these tools report closing their books up to 90% faster each month. Advanced features like automatic indirect cost allocation distribute expenses across programs based on variables like headcount or revenue, eliminating the need for manual calculations.

This level of efficiency lays the groundwork for improving donor management.

Improved Donor and Donation Management

Building on the foundation of streamlined accounting, modern donor management systems centralize contact details, donation histories, and communication preferences. This eliminates data silos and reduces duplication. With 79% of nonprofits leveraging automation for donor-related tasks, technology can handle up to 90% of sponsorship work, including data entry, donation processing, and receipt generation. Automation also enables personalized donor engagement at scale, using segmentation and triggered communications. This tailored approach can boost repeat donations by more than 80%, and even a 10% improvement in donor retention can increase a donor base's lifetime value by 50% or more.

Integrated payment processing ensures that donation forms connect directly to secure payment gateways, recording transactions in real time while maintaining audit trails. Self-service portals allow donors to manage recurring gifts, update their information, and access tax receipts, reducing administrative workload and enhancing the donor experience.

Organizations that adopt integrated fundraising and accounting solutions often see significant gains, with some reporting funding increases of 25% or more within their first year. Take FoodCorps, for example. By adopting cloud-based budgeting software, they overcame data silos and communication challenges. Michelle Emeh, Senior Director of Finance, shared:

"We're able to budget more efficiently... and invest our time savings into analytics and strategy so senior management can make more informed decisions."

HelpYouSponsor: A Complete Solution for Nonprofits

HelpYouSponsor (HYS) is a platform built specifically to address the financial and operational challenges nonprofits face. Designed by experts who understand the intricacies of running sponsorship programs, HYS combines donation management, fund tracking, and donor relationship tools into one seamless system. Whether managing small or large sponsorship programs, HYS provides a centralized solution tailored to nonprofit needs.

Centralized Donation and Donor Management

HYS simplifies donor management by consolidating all donor information and donation activities into one place. With a comprehensive log, the platform tracks every donation and automates key communications, reducing the risk of duplicate entries. Each donation is accompanied by visual data, including donor details, allocation breakdowns, and transaction dates, making it easy to access critical information at a glance.

The system’s Activity Log goes a step further by recording every donor action - successful payments, failed transactions, or updates to donor profiles - creating a complete historical record. Organizations can filter this log to focus on specific categories, such as "Added Sponsorships" under Commitments, for quick access to relevant details. Automated emails ensure smooth communication between sponsors and recipients, triggered by updates like recipient changes or sponsor messages.

HYS also integrates directly with QuickBooks, syncing donations, donor details, and recipient information automatically. This eliminates the hassle of duplicate data entry and keeps accounting records accurate. For even broader functionality, HYS works with Zapier, connecting nonprofits to thousands of third-party apps for enhanced automation.

Automated Reporting and Financial Insights

HYS is designed to grow with nonprofits, offering tools that are both affordable and scalable. The platform generates real-time analytics and custom dashboards, displaying donation metrics like volume, average gift size, and conversion rates. These visual reports make it easy to identify trends and assess program performance at a glance. HYS also distinguishes between reporting - focusing on past transactions - and analytics, which provides insights for future planning.

To ensure funds are used appropriately, the system automatically matches donations with recipients, reducing manual errors in accounting. Security is a priority, with role-based access controls and encryption protecting sensitive donor and financial data.

Flexible pricing plans make HYS accessible to organizations of all sizes. The Free Plan supports up to 10 commitments per month, perfect for smaller nonprofits just starting out. The Pro Plan, at $50 per month, accommodates up to 63 commitments and includes advanced automation features. For larger operations, the Max Plan uses a pay-as-you-go model at $0.80 per commitment, providing scalability without unnecessary costs.

Integrated Payment Processing

HYS streamlines the donation process by integrating directly with popular payment gateways, allowing nonprofits to process transactions right through the platform. This feature is crucial, especially since 64% of U.S. donors prefer to give via credit or debit card online. Once a donation is processed, HYS instantly generates receipts and thank-you messages, keeping donors engaged while reducing the workload for staff.

This automated system not only saves time but also ensures accuracy, syncing all financial data with QuickBooks. Considering that grant recipients often spend up to 40% of their resources on administrative tasks, this efficiency can make a huge difference. As Matthew Pierce, CEO of E4E Relief, puts it:

"Retaining the flexibility we need while meeting those expectations necessitates evaluating enhancement opportunities and using sophisticated tools".

For organizations with unique requirements, HYS offers flexibility. While its integrated payment gateways provide a plug-and-play solution, nonprofits can also record external payments when needed. Additionally, Mailgun integration ensures reliable delivery of transactional emails and donor notifications. With customizable short codes, organizations can personalize automated emails, creating a more engaging experience for donors and sponsors alike.

Best Practices for Implementing Financial Technology

To make the most of financial technology, nonprofits need to approach its adoption with careful planning and a commitment to change management. With 74% of nonprofits identifying digital transformation as a key goal, the pressure to modernize is undeniable. But rushing into new systems can lead to frustrated teams and wasted resources.

Start by creating a business case that highlights the risks in your current processes and explains how the new technology aligns with your mission. Conduct a stakeholder analysis to understand concerns across departments, and identify internal "champions" who can advocate for the change.

Before transitioning to a new system, take the time to clean up existing data. This means updating vendor lists, closing unused accounts, and organizing your chart of accounts to ensure historical data remains useful. These steps lay the groundwork for maintaining data accuracy and preparing your team for the transition.

Protecting Data Security and Maintaining Compliance

With cyberattacks on nonprofits increasing by 30% in 2024, data security is more critical than ever. Alarmingly, 20% of nonprofits still lack a dedicated cybersecurity program, leaving sensitive donor and financial data at risk. When considering platforms like HYS, look for features like multi-factor authentication (MFA) and encryption to safeguard information.

Adopting a zero trust model can further protect your data. Limit access to financial records based on job roles - most staff don’t need full visibility into donor details or payment systems. Role-based access controls reduce exposure to potential breaches. Additionally, carefully vet third-party vendors, including cloud storage providers and payment processors, to ensure their security measures meet industry standards.

Compliance is another critical area to address. With 47 U.S. states requiring nonprofits to notify individuals in the event of a data breach, having a solid incident response plan is essential. This plan should include a clear chain of command, contact lists for IT and legal teams, and pre-drafted communications for stakeholders. As Deep Why Design emphasizes:

"you don't want to take unnecessary risks when it comes to your organization's important work and the communities you serve".

Consider cloud-based solutions that automatically update security patches and ensure compliance with regulations, reducing the workload for your internal team. Implement the 3-2-1 backup strategy: keep three copies of your data on two different media types, with one copy stored offsite in an immutable vault. These measures not only protect your organization's reputation but also help maintain donor trust and financial transparency.

Training Staff for Technology Adoption

Even the most advanced financial tools are ineffective if your team doesn’t know how to use them. As Brooke Belott, Senior Strategist at Heller Consulting, wisely points out:

"Technology will only move your organization forward if your staff knows how to use it".

Plan training sessions well in advance, and be ready for a temporary dip in productivity as staff adjust. Clearly communicate the benefits of the new system, emphasizing how it will simplify individual roles, not just improve overall efficiency. Use a sandbox environment with mock data to let staff practice without risking live records. This hands-on learning approach builds confidence and allows for trial and error.

Tailor training methods to suit different roles. Options include microlearning modules for quick reference, flipped classroom sessions where staff complete online lessons before group discussions, or gamification techniques like badges to encourage participation. Start with a small pilot group before rolling out the program organization-wide. Department-level champions can also provide ongoing support. Proper training ensures your team can fully leverage the new system, avoiding delays and maximizing the benefits of improved financial management.

Measuring Impact and Scaling Technology Use

To ensure the new financial technology delivers value, track its impact with clear KPIs. Examples include labor hours saved on reporting, higher online donation conversion rates, or faster month-end closings. As BDO notes:

"when done properly, change management can accelerate the return on investment (ROI) the organization is seeking from new technology".

Evaluate progress regularly - quarterly or semi-annually - to spot areas for improvement and confirm the system is being used effectively. Since 34% of nonprofits collect data but don’t fully use it for decision-making, make sure your organization avoids this pitfall.

As your nonprofit grows, expand your technology use thoughtfully. Go beyond tracking financial transactions; measure program outcomes and donor retention rates to enhance your storytelling. This data-driven strategy not only improves operations but also strengthens your credibility with funders and stakeholders, reinforcing the financial management practices highlighted throughout this guide.

Conclusion

Financial management should support and strengthen your mission. As outlined earlier, modern financial tools don’t just handle routine tasks - they create opportunities for strategic growth. With technology, budgeting, expense tracking, donor management, and compliance become more efficient, saving time and reducing the risk of errors.

These improvements lead to real-world results. For example, Save the Children reported a 30% boost in donor engagement and cut administrative costs by 25% within a year of adopting an advanced donor management system. Automation-driven personalized outreach can increase repeat donations by over 80%, while data-informed decisions can improve program efficiency by as much as 75%.

HelpYouSponsor builds on these capabilities with a platform designed specifically for sponsorship-based nonprofits. It simplifies managing sponsorship programs through features like automated donor-recipient matching, integrated payment processing, real-time financial reporting, and built-in compliance tools. Plus, it’s cost-effective, starting free for up to 10 commitments per month.

As the HelpYouSponsor Team puts it:

"Automation isn't just about efficiency - it's a way to stay competitive in today's fundraising landscape".

By centralizing financial operations, safeguarding donor data with bank-level encryption, and offering the transparency funders demand, technology doesn’t just streamline your workflows - it strengthens your organization’s credibility and ability to make a difference.

Ask yourself: Can you afford not to invest in these tools? Every hour spent on manual tasks is time taken away from your mission. Every missed donor or compliance risk from outdated systems is a setback to your goals. The solutions are here - accessible, affordable, and proven. It’s time to make them work for you.

FAQs

How can nonprofits use modern tools to improve donor management?

Modern financial tools are transforming how nonprofits handle donor management by automating essential tasks. These tools take care of things like processing donations, sending out personalized thank-you messages, and securely managing donor records. The result? Fewer errors, up-to-date data, and more time for staff to focus on nurturing relationships with supporters.

Another game-changer is the ability to create personalized outreach. This tailored approach can lead to more repeat donations and deepen connections with donors. On top of that, advanced analytics offer insights into donor behavior, making it easier for nonprofits to refine their strategies, recognize major contributors, and keep supporters engaged. By simplifying processes and improving communication, these tools help nonprofits manage donors more efficiently and effectively.

What are the key advantages of using cloud-based tools for managing nonprofit finances?

Cloud-based tools bring several standout benefits to nonprofits looking to streamline their financial management. First, they offer cost savings by cutting out the need for pricey on-site servers and extensive IT support. Instead, organizations can rely on these platforms to handle the heavy lifting without breaking the bank.

Security is another big win. With advanced encryption and regular backups, sensitive financial data stays protected from potential threats. Plus, with remote access, your team can collaborate and manage finances from anywhere - whether they're in the office, at home, or halfway across the country.

Another perk? Automatic updates. These tools ensure your organization is always running the latest features without the hassle of manual installations. And because they integrate easily with other software, tasks like budgeting, tracking expenses, and managing donors become much more efficient, giving you better financial oversight and smoother operations overall.

How can technology help nonprofits stay compliant and manage reporting requirements effectively?

Technology has become a game-changer for nonprofits, especially when it comes to staying compliant and keeping up with reporting requirements. Tools like fund accounting software make it easier to track every dollar - whether it’s tied to a grant, contract, or program. This level of tracking helps organizations maintain transparency, minimize errors, and produce detailed reports tailored to specific funder or regulatory needs.

These tools also simplify audit preparation by bringing all financial data together in one place, automating repetitive tasks, and offering real-time insights into an organization’s finances. Features such as automated expense tracking and AI-powered bookkeeping not only enhance accuracy but also save valuable time. This allows nonprofits to focus more on their mission while still meeting donor and regulatory expectations. By adopting these modern solutions, organizations can build trust with their stakeholders and handle compliance requirements effortlessly.